Electric Vehicle Charging Stations Analysis and Equity Consideration

To further advance electric vehicle (EV) adoption, some reports and individuals underscore the pivotal role of EV infrastructure. Beyond economic considerations and battery condition, the development of a thorough EV charging station network is a critical aspect. Aligned with the GHG reduction strategies outlined in PlaNYC, the government has established a goal to ensure that every New Yorker is no more than 2.5 miles from an EV fast charging hub by 2025.

It's important to recognize the symbiotic relationship between EV adoption and infrastructure development. As more individuals embrace EVs, the demand for charging stations increases, driving the expansion of charging infrastructure. Simultaneously, a widespread infrastructure system fosters greater consumer confidence and willingness to invest in EVs.

Objectives

In this report I will delve into the equity aspects of EV charging stations across New York City. By examining demographic and socio-economic factors, I aim to identify areas with limited accessibility to EV facilities. Ultimately, this analysis will inform strategies for EV site selection, ensuring equitable access to charging infrastructure across the city.

Understand EV Infrastructure

EV Connector Types

EV connectors vary in different charging stations. Specific EV connectors ensure safe and efficient charging. According to the station around NYC, four types of connectors, primarily used in North American, are summarized as below:

Learn more: EV Connectors Type

The SAE J1772 Connector is a 5-pin standard charging that support signle-phase alternating current (AC) charging rates. J1772 now becomes the standard equipment in the U.S. market due to the availability of charging stations, normally used in Level 2 Charging Station.

J1772 Combo is a variation of standard J1772, with the support of Combined Charging System (CSS), which is a standard for DC fast charging.

Followed by J1772 plug, J1772 Combo includes the standard 5-pin along with an additional two larger pins to support fast Direct Current (DC) charging. CSS can unify both signle-phase AC charging and high power DC charging.

CHAdeMO (an abbreviation of "CHArge de MOve") is also DC charging standard developed by Japanese power company and automakers. CHAdeMO is supported by several Japanese automakers, including Nissan, Mitsubishi, and Toyota, while BMW, Volkswagen, and General Motors support CCS.

Tesla connector, in North American market, follows North American Charging Standard (NACS), can support both AC charging and DC fast charging. Unlike in the past when the connector was only compatible with Tesla vehicles, it is now becoming available to other EV manufacturers.

EV Charging Station Levels

EV charging stations are classified into three distinct levels based on their charging capabilities: Level 1 (typically used at home), Level 2, and Level3 (also known as DC Fast Charge). According to data from the NYS DOT, public charging stations in the city primarily fall into two categories: Level 2 and DC Fast Charge (DCFC).

Learn more: Electric Vehicle Station Locator / Electric Vehicle Charger Levels and Speeds

Level 2 Chargers

For daily use

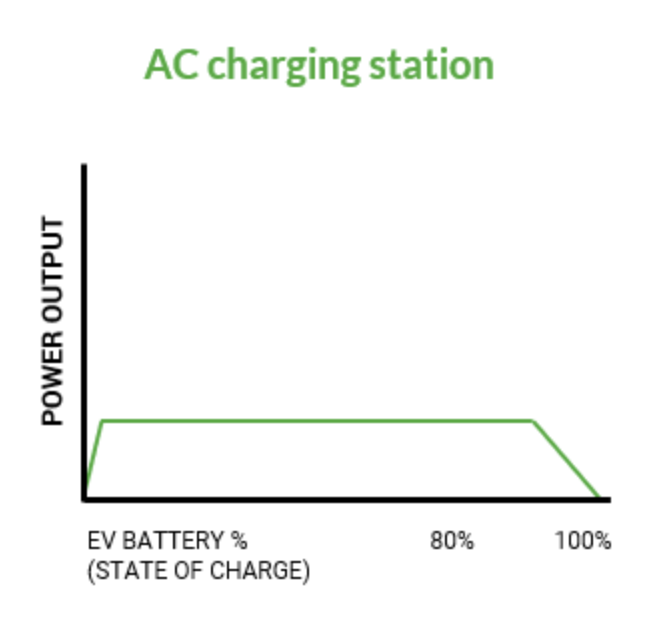

Level 2 Charging Stations are frequently in commercial settings, and at home. It could add 18-28 miles of range per hour and can fully charge an average EV in about 8 hours. Charging speed for level 2 range from 3 to 19.2 kilowatts (kW) in the US. These chargers are most appropriate for charging while parked for one or more hours at home, work, or while shopping. Most Level 2 stations in NYC are equipped with J1772 connectors

Level 3 Chargers / Direct Current Fast Chargers (DCFC)

Rapid charging / For medium- and heavy-duty EV fleets

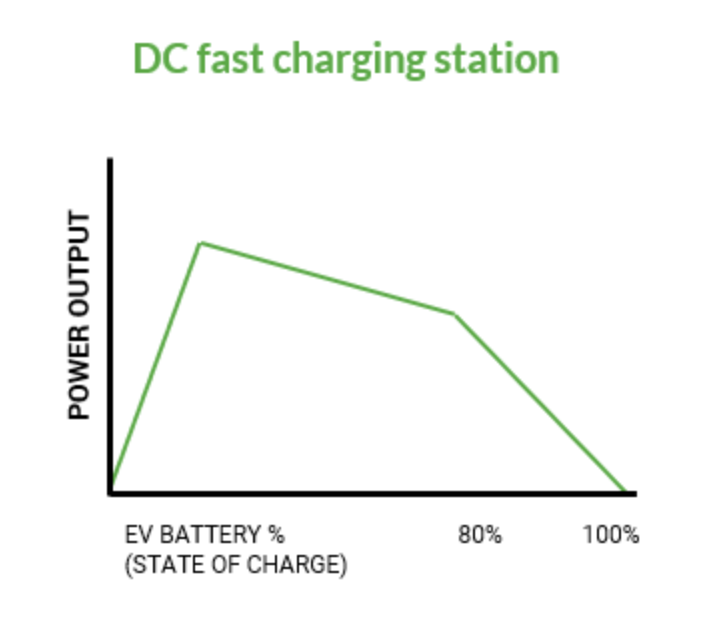

DCFC, typically found along heavy travel corridors, are obviously the fastest-charging stations. It could add 60 to 200 or more miles of charge in 20 minutes. Charging speed for DCFC range from 50 to 350 kilowatts (kW) in the US. Most fast charging stations in NYC are equipped with CSS and CHAdeMO connectors, and NACS for Tesla.

EV Charging Station Feature Analysis

In the 2030 National Charging Network Report from NREL, researchers describe the entire network as a tree. Private charging, including charging at home and workplace, constitutes the invisible roots of the network. As the foundation of the network tree, it is estimated to require half (52%) of the national investment to achieve accessibility by 2030. Apart from private charging, the visible components of the tree belong to public charging. A reliable public fast charging network serves as the trunk to enhance the network accessibility. Given its high costs for utility upgrades and power procurement, an estimated 39% of the investment will be allocated to fast charging. The final component of the system is public destination charging, resembling branches that flourish in dense neighborhoods. The growth of public destination charging relies on support from charging infrastructure elsewhere. Approximately 9% of the investment will be directed towards these branches.

Based on the assumption of mid-adoption (33 million PEVs), the simulated 2030 network estimates that 3 ports/100 PEVs will be accessible at private multi-family homes and workplaces, 1.5 ports/100 PEVs at public Level 2, and 0.6 ports/100 PEVs at public DC charging nationally.

Using the estimation report and charging station locator data from the Alternative Fuels Data Center (AFDC), this section will examine the tree structure: private charging, public fast charging (DCFC), and public destination charging (Level 2), in terms of quantity, location, and cost.

Private Charging: Home charging is essential

Quantity: As the dataset only displays non-residential stations, we are unable to fully assess the station of home charging. Apart from the residential charging, there are 37 station locations recorded.

Location: In early 2024, Hilltop Village Co-op in Queens installed the largest residential EV charging stations in NYC. Granted by Con Edison and NYSERDA, there are 423 chargers across the garages and outdoor parking lots. Undoubtedly, it set an example for future construction in multi-unit dwellings. Besides home charging, some are located at workplaces in office building (Verizon, Spectrum) and on college campus (Fordham), while others belong to commercial and government fleets such as DHL, U.S. Postal Service (USPS) and New York City Police Academy.

Cost: Home charging is pivotal within the charging network as electric vehicles tend to remain parked overnight. While it might be easier for single-family households, investments are needed to ensure network access for renters, multi-unit dwellings (apartments), and single-family homes without off-street parking access. Based on cost assumptions, the installation cost per port is $100 - $1000 for Level 1 residential charging and $500 - $1700 for Level 2 residential charging. Affordability in charging and an efficient installation process, especially in multi-unit dwellings, can better promote the home charging network. Workplace charging could provide a valuable benefit for employees and enhance awareness of alternative energy sources. Based on EVSE cost report in 2015, Level 2 at workplace sites costs $2,704 per port and $3,842 per EVSE on average.

Public Fast Charging: Enhance the reliability of charging network

Quantity: Even though 39% of the network investment flows into DC fast charging, it is estimated to constitute a relatively small portion of the total number of stations. So far, 43 DCFC stations have been counted, with 12 of them being Tesla Superchargers.

Location: Since fast charging primarily targets long-distance trips and fleets, these stations are predominantly situated along main traffic corridors to facilitate efficient refueling during short breaks. However, charging stations within communities are crucial as well since they enable future growth with a convenient system. In NYC, three current charging sites operated by Revel stand out in the dataset with their significant number of ports: Bedford-Stuyvesant (25 ports), Long Island City (14 ports), and South Williamsburg (15 ports). Additionally, more than half of Tesla Superchargers are constructed with more than 10 ports, with most of them located near or within shopping centers.

Cost: According to collected studies in the report, 150-kW DC chargers cost around $45,800 to $94,000 while DC chargers with power ratings of 350+ kW require an investment of $63,700 to $117,900 for each port installation. This costly investment is attributed to the increased labor and advanced materials required for construction.

Public Destination Charge: Aligning with daily behavior pattern

Quantity: Similar to tree branches, public destination charging further expands the network to cater to drivers' daily activities, with each "leaf" (station) contributing to reducing charging congestion. There are 634 public Level 2 charging stations counted, with 318 of them being Tesla Destination. Regarding charging companies, aside from Tesla, ChargePoint Network, Blink Network, LIVINGSTON, and FLO constitute the top five in terms of Level 2 station quantity.

Location: The research indicate that the Level 2 average hourly utilization rate peaks in the late morning. Positioned in dense neighborhoods, public Level 2 stations meet the demand for non-residential access for both occasionally long-duration activities and frequent short-duration convenient charging. Most Level 2 stations in NYC are clustered in Manhattan, downtown Brooklyn, Williamsburg, and Long Island City. Stations constructed by charging companies are often located in pay parking garages to ensure profitability. Stations built by FLO are operated by the NYC DOT and are typically placed curbside with relative low or no entry fees for parking. Generally, municipally-operated charging stations try to exclude the Central Business District (south of 60th in Manhattan) in line with the congestion pricing regulations. Some of them are situated at or near hotspot areas such as medical facilities, recreational facilities.

Cost: The installation costs for each port range from $2,200 to $6,000 approximately.

Equity Consideration on EVSE

A sustainable and equitable investment strategy in electric vehicle support equipment (EVSE) is critical to facilitate the EV transition. The Justice40 Initiative from the federal government states that 40% of the overall benefits of certain Federal investments flow to disadvantaged communities (DACs). EVSE has been deployed in well-resourced communities with many early adapters to meet EV drivers' demands. However, DACs often lack clean and reliable transportation, resulting in a high transportation energy burden. To prioritize the benefits of these underserved communities, the researchers from the Argonne National Laboratory elaborated on the methodology to measures underserved census tracts in the study Using Mapping Tools to Prioritize Electric Vehicle Charger Benefits to Underserved Communities. In this section, 4 scenarios in terms of community charging are conducted to identify EEJ underserved communities in New York City. Even though mapping data layers are effective, how to locate EVSE in a specific place in the neighborhood requires stakeholder engagement at all times.

Number of public EVSE ports within 15-minute walking distance

Number of public EVSE ports within 15-minute driving distance

Using the TomTom Route API, the number of reachable ports at the census tract level is calculated based on defined population centroid. Within a 15-minute driving distance, most blocks have access to more than 50 public EVSE ports, while southeastern Brooklyn lacks sufficient accessibility to ports. For calculation within 15-minute walking distance, it is obvious that aside from high-density areas in Manhattan, Brooklyn and Long Island City, most neighborhoods have inadequate walking-friendly ports.

Scenario B1: Disadvantaged Communities + Public EVSE Density Ranges

Map Layers and Data Source:

- List of Disadvantaged Communities (identified be New York's Climate Act)

- Public EVSE Density (L2 + DCFC):

- Number of public EVSE ports within 15 driving minutes

- Number of public EVSE ports within 15 walking minutes

Disadvantaged Communities (DACs) could be considered a summarization of "underserved communities", which incorporate multiple criteria in terms of population characteristic and health vulnerabilities (some criteria are also specified in B2 and B3 cases). In this case, DACs in the Bronx and East Brooklyn need more walkable ports to prioritize the benefits of those communities.

Scenario B2: Low Income/Community of Color + Low Public EVSE Density

Map Layers and Data Source:

-

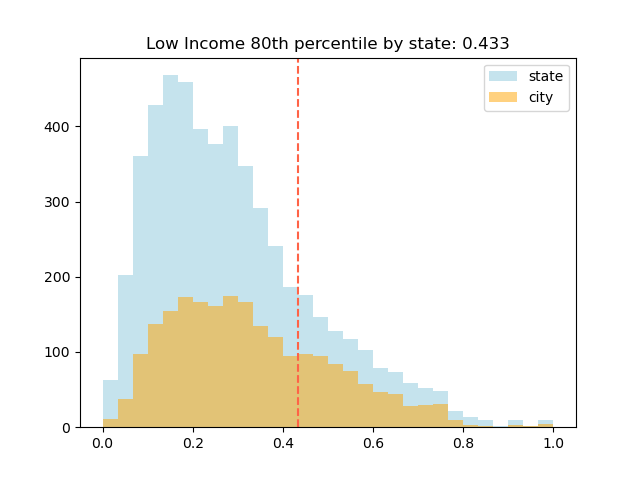

Low-income census tract percentage >= statewide 80th percentile (2022 ACS 5-Year Estimates)

EPA EJScreen Definition: Percent of individuals whose ratio of household income to poverty level in the past 12 months was less than 2.

-

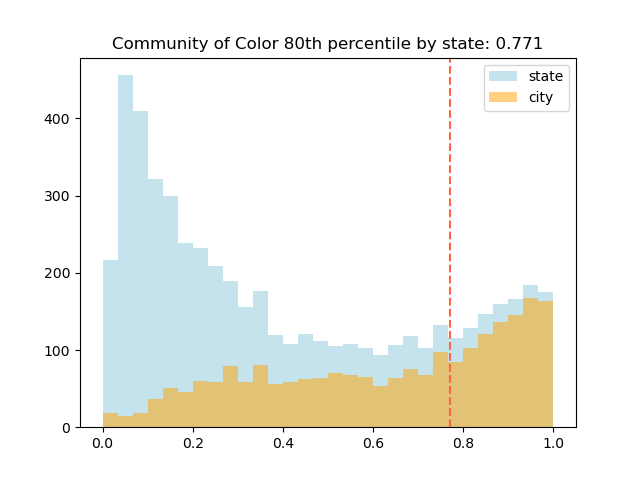

Community of color census tract percentage >= statewide 80th percentile (2022 ACS 5-Year Estimates)

EPA EJScreen Definition: The percent of individuals in a block group who list their racial status as a race other than white alone and/or list their ethnicity as Hispanic or Latino.

-

Low Public EVSE Density (L2 + DCFC):

- 0-10 public EVSE ports within 15 driving minutes

- 0-10 public EVSE ports within 15 walking minutes

The communities of color located in Bronx, East Brooklyn, and East Queens, where most of them are above the 80th percentile at the state-level.

A certain number of reachable ports can facilitate racial justice in EV adoption.

Low-income neighborhoods are clustered in Bronx and Brooklyn, which have fewer or no ports within walking distance.

Constructing affordable and walkable public EVSE ports can benefit community with more available charging and commercial opportunities.

Scenario B3: High MFH Density/High Rental Density + Low Public EVSE Density

Map Layers and Data Source:

-

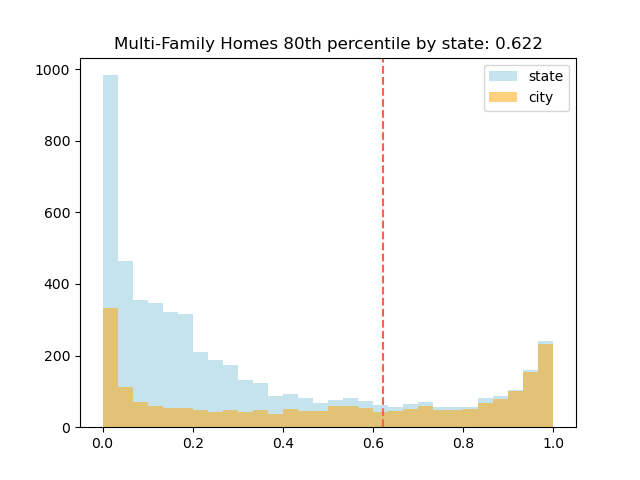

Multi-Family Homes density percentage >= statewide 80th percentile (2022 ACS 5-Year Estimates)

Definition: Five units or more percentage by Units in Structure

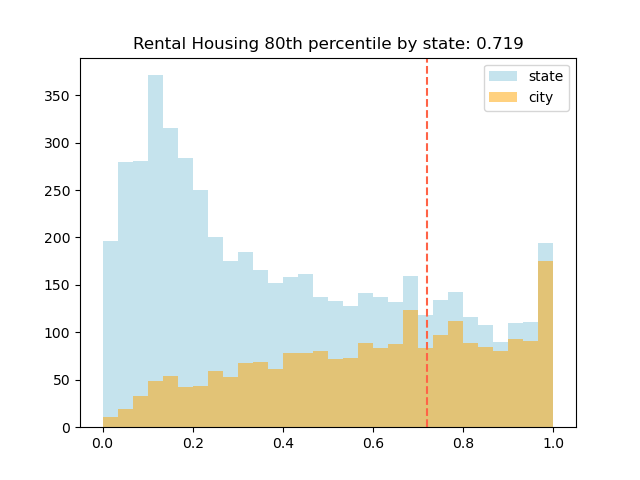

- Renter-occupied density percentage >= statewide 80th percentile (2022 ACS 5-Year Estimates)

Definition: Renter-occupied percentage in Occupied Housing Units by Tenure by Units in Structure

-

Low Public EVSE Density (L2 + DCFC):

- 0-10 public EVSE ports within 15 walking minutes

High density in multi-family homes and rental housing follows the similar patterns, except in Manhattan. EV drivers who live in those areas need a place for affordable long-time charging if they are unable to access private charging. Residents from Bronx and some areas of Brooklyn (identified as low-income areas in B2) need more accessible public Level 2 ports for overnight charging.

Summary

The report delves into EV supply equipment to provide a basic understanding of the infrastructure, analyze current charging stations in the city, and address equity considerations in underserved communities. Based on the NERL report, half of the simulated investment needs to be placed in private charging as the foundation of the network. In the context of New York metropolitan area, public L2 network contribute significantly (3 ports/100 PEVs) compared to the national average (1.5 ports/100 PEVs) to compensate for insufficient accessibility in private charging (region: 1.9 ports/100 PEVs; nation: 3 ports/100 PEVs).

To develop an equitable strategy for public EVSE and align with Justice40 initiatives, three scenarios in community charging are mapped based on the methodology. By mapping demographic characteristics with EVSE density, stakeholders can gain insight into prioritizing underserved communities. Furthermore, stakeholder engagement to finalize the charging locations is always crucial during planning to ensure the benefits to the community.